If you're a Class 12 Economics student, you'll need to understand the concepts of liberalization, privatization, and globalization (LPG) provided in the Indian Economic Development book Chapter 3. These notes provide a comprehensive overview of these economic policies, including their history, benefits, and drawbacks. Use these study materials to prepare for your exam and achieve academic success.

| Board | CBSE and State Boards |

| Class | 12 |

| Subject | Economics |

| Book Name | Indian Economic Development |

| Chapter No. | 3 |

| Chapter Name | Liberalization, Privatization, and Globalization: An Appraisal |

| Type | Notes |

| Session | 2023-24 |

"The best way to get started is to quit talking and begin doing."

- Walt Disney

Liberalization, Privatization, and Globalization Class 12 Notes

Table of Contents

Factors that Necessitated Economic Reforms

In 1991, India met with an economic crisis

- A steep fall in foreign exchange reserves: Foreign exchange reserves, which we generally maintain to import petroleum and other important items, dropped to levels that were not sufficient for even a fortnight.

- An unfavorable Balance of Payments (BOP): Imports grew at a very high rate without matching the growth of exports.

- A huge burden of external debt: The government was not able to make repayments on its borrowings from abroad. There was also not sufficient foreign exchange to pay the interest that needed to be paid to international lenders.

- High rate of price inflation: Prices of many essential goods rose sharply.

- A huge burden of fiscal deficit in the government budget: When expenditure is more than income, the government borrows to finance the deficit from banks and also from people within the country and from international financial institutions. The revenue from taxation and public sector undertakings was lower than the expenditure incurred on developmental policies.

India approached

- the International Bank for Reconstruction and Development (IBRD), popularly known as World Bank and

- the International Monetary Fund (IMF),

and received $7 billion as a loan to manage the crisis.

For availing the loan, these international agencies expected India to

- liberalize and open up the economy by removing restrictions on the private sector,

- reduce the role of the government in many areas, and

- remove trade restrictions between India and other countries.

Dr. Manmohan Singh was the Finance Minister of India in 1991.

The New Economic Policy (NEP)

India agreed to the conditionalities of the World Bank and IMF and announced the New Economic Policy (NEP). This set of policies can broadly be classified into two groups: the stabilization measures and the structural reform measures.

i. Stabilization measures:

Stabilization measures are short-term measures, intended to correct some of the weaknesses that have developed in the balance of payments and to bring inflation under control. In simple words, this means that there was a need to maintain sufficient foreign exchange reserves and keep the rising prices under control.

ii. Structural reform policies:

Structural reform policies are long-term measures, aimed at improving the efficiency of the economy and increasing its international competitiveness by removing the rigidities in various segments of the Indian economy.

The government initiated a variety of policies that fall under three heads viz., liberalization, privatization, and globalization.

Liberalization

Liberalization was introduced to put an end to these restrictions and open various sectors of the economy.

Though a few liberalization measures were introduced in the 1980s in areas of industrial licensing, export-import policy, technology upgradation, fiscal policy, and foreign investment, reform policies initiated in 1991 were more comprehensive.

1.Deregulation of the Industrial Sector:

- Industrial licensing was abolished for almost all but product categories — alcohol, cigarettes, hazardous chemicals, industrial explosives, electronics, aerospace, and drugs and pharmaceuticals.

- The only industries which are now reserved for the public sector are a part of atomic energy generation and some core activities in railway transport.

- Many goods produced by small-scale industries have now been de-reserved.

- In most industries, the market has been allowed to determine the prices

2. Financial Sector Reforms:

- The role of RBI was changed from regulator to facilitator of the financial sector. This means that the financial sector may be allowed to take decisions on many matters without consulting the RBI.

- The foreign investment limit in banks was raised to around 74%.

- Those banks which fulfill certain conditions have been given the freedom to set up new branches without the approval of the RBI and rationalize their existing branch networks.

- Foreign Institutional Investors (FII), such as merchant bankers, mutual funds, and pension funds, are now allowed to invest in Indian financial markets.

3. Tax Reforms:

- Direct taxes

- Since 1991, there has been a continuous reduction in the taxes on individual incomes as it was felt that high rates of income tax were an important reason for tax evasion

- The rate of corporation tax, which was very high earlier, has been gradually reduced.

- Indirect taxes

- In 2016, the Indian Parliament passed a law, Goods and Services Tax Act 2016, to simplify and introduce a unified indirect tax system in India. This law came into effect in July 2017.

- GST subsumed value-added tax, service tax, excise duty, and sales tax.

- Another component of reform in this area is simplification. In order to encourage better compliance on the part of taxpayers, many procedures have been simplified and the rates also substantially lowered.

4. Foreign Exchange Reforms:

- In 1991, as an immediate measure to resolve the balance of payments crisis, the rupee was devalued against foreign currencies. This led to an increase in the inflow of foreign exchange.

- It also set the tone to free the determination of rupee value in the foreign exchange market from government control.

5. Trade and Investment Policy Reforms:

- Import licensing was abolished except in the case of hazardous and environmentally sensitive industries.

- Quantitative restrictions on imports of manufactured consumer goods and agricultural products were also fully removed from April 2001.

- Export duties have been removed to increase the competitive position of Indian goods in the international markets.

Privatization

It implies shedding the ownership or management of a government-owned enterprise.

Government companies are converted into private companies in two ways:

- by the withdrawal of the government from ownership and management of public sector companies and/or

- by the outright sale of public sector companies.

Disinvestment: Privatization of the public sector enterprises by selling off part of the equity of PSEs to the public is known as disinvestment.

The purpose of the sale was mainly to

- improve financial discipline and facilitate modernization.

- It was also envisaged that private capital and managerial capabilities could be effectively utilized to improve the performance of the PSUs.

- The government envisaged that privatization could provide a strong impetus to the inflow of FDI.

Maharatnas, Navratnas, and Miniratnas

In order to improve efficiency, infuse professionalism and enable them to compete more effectively in the liberalized global environment, the government identifies PSEs and declares them as maharatnas, navratnas, and miniratnas.

They were given greater managerial and operational autonomy, in taking various decisions to run the company efficiently and thus increase their profits.

A few examples of public enterprises with their status are as follows:

(i) Maharatnas –

- (a) Indian Oil Corporation Limited, and

- (b) Steel Authority of India Limited,

(ii) Navratnas –

- (a) Hindustan Aeronautics Limited,

- (b) Mahanagar Telephone Nigam Limited

(iii) Miniratnas –

- (a) Bharat Sanchar Nigam Limited;

- (b) Airport Authority of India

- (c) Indian Railway Catering and Tourism Corporation Limited.

Globalization

- It means integration of the economy of the country with the world economy.

- Transforming the world towards greater interdependence and integration.

- It is turning the world into one whole or creating a borderless world.

Outsourcing:

- In outsourcing, a company hires regular service from external sources, mostly from other countries, which was previously provided internally or from within the country (like legal advice, computer service, advertisement, and security — each provided by respective departments of the company).

- Many of the services such as voice-based business processes (popularly known as BPO or call centers), record keeping, accountancy, banking services, music recording, film editing, book transcription, clinical advice or even teaching are being outsourced by companies in developed countries to India.

- With the help of modern telecommunication links including the Internet, the text, voice, and visual data in respect of these services is digitized and transmitted in real time over continents and national boundaries.

- Most multinational corporations, and even small companies, are outsourcing their services to India where they can be availed at a cheaper cost with a reasonable degree of skill and accuracy. The low wage rates and availability of skilled manpower in India have made it a destination for global outsourcing in the post-reform period.

World Trade Organisation (WTO):

- The WTO was founded in 1995 as the successor organization to the General Agreement on Trade and Tariffs (GATT).

- It administers all multilateral trade agreements by providing equal opportunities to all countries in the international market for trading purposes.

- WTO is expected to establish a rule-based trading regime in which nations cannot place arbitrary restrictions on trade.

- Its purpose is also to enlarge the production and trade of services, to ensure optimum utilization of world resources, and to protect the environment.

- The WTO agreements cover trade in goods as well as services to facilitate international trade (bilateral and multilateral) through the removal of tariff as well as non-tariff barriers and providing greater market access to all member countries.

India's Commitment to the WTO

- Reduction in tariff rates

- Removal of quantitative restrictions.

Positive Impacts of Globalization

- Increased economic growth: Globalization has led to increased economic growth in many countries, as businesses are able to expand into new markets and consumers have access to a wider variety of goods and services.

- Improved standards of living: Globalization has helped to improve the standards of living in many countries, as businesses have invested in developing countries and created jobs.

- Increased access to technology: Globalization has made it easier for people in developing countries to access technology, which has helped to improve education, healthcare, and other important services.

- Increased cultural understanding: Globalization has helped to increase cultural understanding between different countries, as people have become more aware of different cultures and traditions.

Negative Impacts of Globalization

- Increased inequality: Globalization has led to increased inequality in some countries, as businesses have moved jobs to developing countries where labor is cheaper.

- Environmental degradation: Globalization has led to increased environmental degradation, as businesses have increased their production and consumption of goods and services.

- Loss of jobs: Globalization has led to the loss of jobs in some countries, as businesses have moved jobs to developing countries where labor is cheaper.

- Increased risk of conflict: Globalization has increased the risk of conflict between countries, as competition for resources and markets has increased.

Indian Economy During Reforms: An Assessment

Positive Impacts

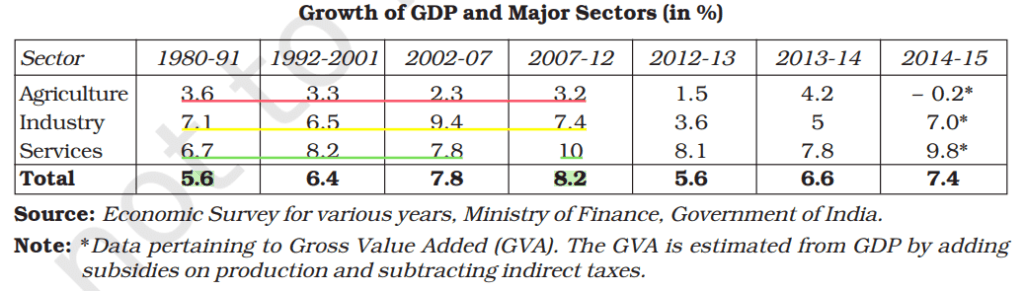

1.Growth in GDP

The trend of growth from 1980-91 to 2007-2012

- The growth of GDP increased from 5.6% during 1980–91 to 8.2% during 2007–12.

- The growth of agriculture has declined.

- While the industrial sector reported fluctuation.

- The growth of the service sector has gone up.

- This indicates that GDP growth is mainly driven by growth in the service sector.

The trend of growth from 2012 to 2015

- Agriculture recorded a high growth rate during 2013–14 but witnessed negative growth in the subsequent year.

- The industrial sector witnessed a steep decline during 2012–13, in the subsequent years it began to show continuous positive growth.

- The service sector continued to witness a high level of growth — higher than the overall GDP growth. In 2014–15, this sector witnessed a high growth rate of 9.8%.

2. The opening of the economy has led to a rapid increase in foreign direct investment and foreign exchange reserves:

- Foreign investment, which includes foreign direct investment (FDI) and foreign institutional investment (FII), has increased from about US $100 million in 1990-91 to US $ 30 billion in 2017-18.

- There has been an increase in the foreign exchange reserves from about US $ 6 billion in 1990-91 to about US $ 413 billion in 2018-19. India is one of the largest foreign exchange reserve holders in the world.

3. Since 1991, India is seen as a successful exporter of auto parts, pharmaceutical goods engineering goods, IT software, and textiles.

4. Rising prices have also been kept under control.

Negative Impacts

1.Growth and Employment

- Though the GDP growth rate has increased in the reform period, scholars point out that the reform-led growth has not generated sufficient employment opportunities in the country.

2. Reforms in Agriculture

- The growth rate of the agriculture sector has been decelerating.

- Public investment in the agriculture sector especially in infrastructure like irrigation, power, etc. has been reduced in the reform period.

- The reduction of fertilizer subsidies has increased the cost of production affecting thereby the small and marginal farmers.

- Increased international competitiveness due to liberalization and reduction of import duties.

- Shift from food crops to cash crops due to export-oriented policy in agriculture led to a rise in prices of food grains.

3. Reforms in Industry

- Industrial growth has also recorded a slowdown. This is because of decreasing demand for industrial products.

- Cheaper imports have, thus, replaced the demand for domestic goods. Domestic manufacturers are facing competition from imports.

- Globalization is creating conditions for the free movement of goods and services from foreign countries that adversely affect the local industries and employment opportunities in developing countries.

4. Disinvestment

- The assets of PSEs have been undervalued and sold to the private sector. There has been a substantial loss to the government and the outright sale of public assets.

- The proceeds from disinvestment are used to offset the shortage of government revenues rather than using it for the development of PSEs and building social infrastructure in the country.

5. Reforms and Fiscal Policies

- The tax reductions in the reform period have not resulted in an increase in tax revenue for the government.

- The reform policies, involving tariff reduction, have curtailed the scope for raising revenue through customs duties.

- In order to attract foreign investment, tax incentives are provided to foreign investors which further reduced the scope for raising tax revenues.

- This has a negative impact on developmental and welfare expenditures.

| Must See: Liberalization, Privatization, and Globalization Class 12 Important Questions Answers Indian Economy 1950-1990 Class 12 Notes National Income and Related Aggregates Class 12 Notes |

| Also Read: Class 12 Important Questions Class 12 Notes |

Hope you liked these Notes on Class 12 Economics Indian Economic Development Chapter 3 Liberalization, Privatization, and Globalization. Please share this with your friends and do comment if you have any doubts/suggestions to share.